Partner Kristen B. Degnan obtained trial verdict of no cause of action in the case of Schultz v. Siu Lam, LLC. The plaintiff alleged shopping plaza owners of neglecting to provide a reasonably safe parking lot wherein she fell on a crack or seam in the recently sealed pavement. After a bifurcated jury trial of negligence only, the jury returned a verdict of no cause, finding that the building owners were not negligent in providing safe conditions in the buildings parking lot. Congratulations Kristen!

News

CELEBRATING 95 YEARS!!!

This year we are celebrating our 95th anniversary of doing what we love! We are proud to have served our clients for 95 years and look forward to the next 95 years!!!

Partner Paul Callahan was named Chair of the Insurance Coverage Committee of the Torts, Insurance & Compensation Law Section of New York State Bar Association

Congratulations to Partner Paul Callahan on becoming the Chair of the Insurance Coverage Committee of the Torts, Insurance & Compensation Law Section of New York State Bar Association!

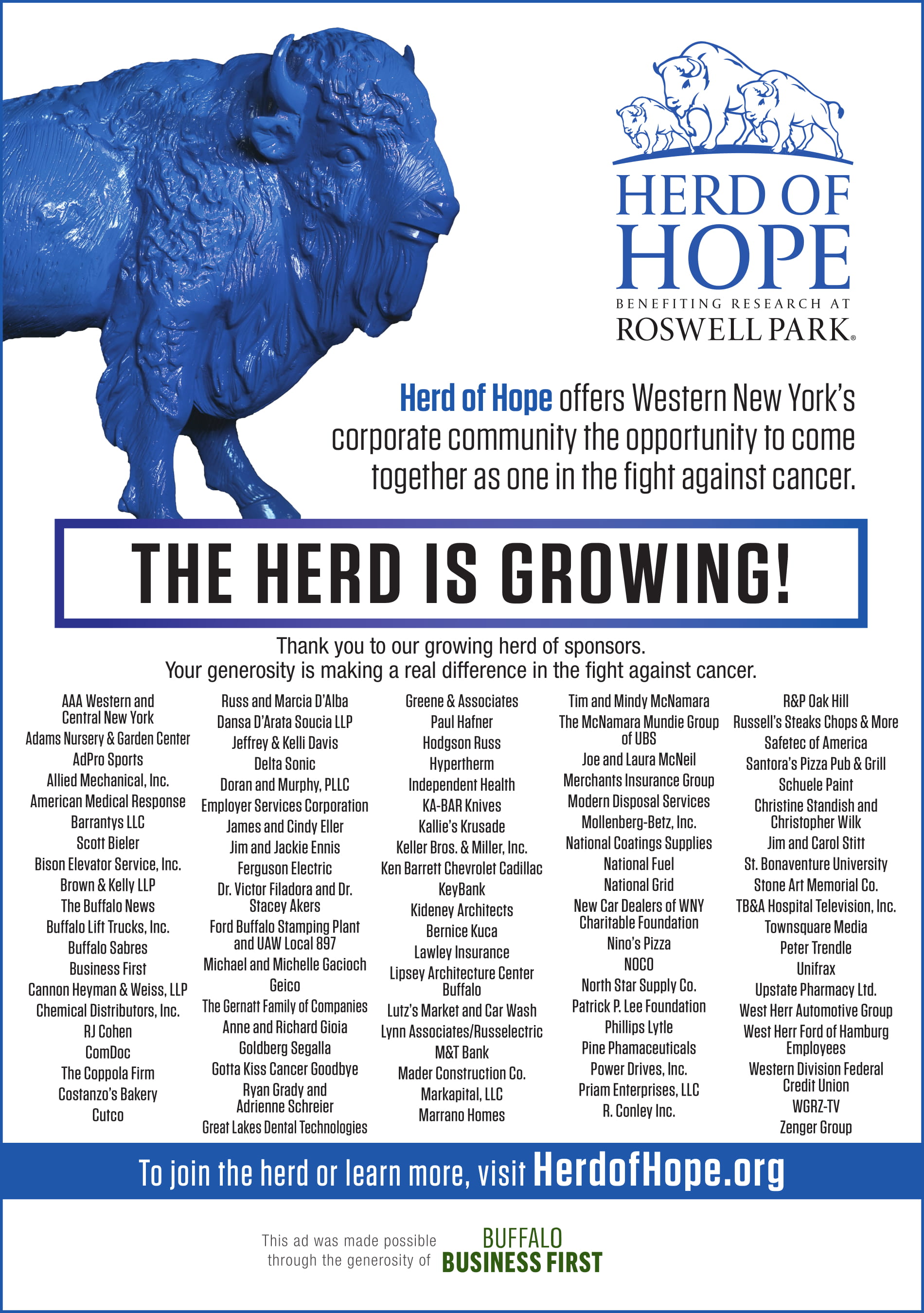

PROUD TO BE PART OF THE GROWING HERD OF HOPE

More and more local businesses are teaming up with Roswell Park’s Herd of Hope campaign in their fight against cancer. We are proud to be part of this growing herd and hope someday there will be a cure to this horrible disease.

Brown & Kelly has joined the “Herd of Hope campaign with Roswell Park.

Brown & Kelly has joined local businesses in support of Roswell Park’s “Herd of Hope” campaign in their fight against cancer. By making a corporate donation to Roswell Park, we have been awarded a“blue buffalo” acknowledging our support. We are also featured on Roswell’s Herd of Hope campaign website, https://herdofhope.org/sponsors/. We are all very proud to be a part of Roswell’s program! Happy Holidays!

HOW YOUR PERSONAL INJURY PAYOUT COULD BE AFFECTED BY TRUMP’S NEW TAX PLAN

President Donald Trump’s new tax plan, The Tax Cuts and Jobs Act of 2017, signed into law on December 22, 2017, has changed how parties are taxed on personal injury payouts. Prior to this new tax plan, court-ordered payouts or negotiated settlements in car accidents, slip and falls, medical malpractice, and products liability cases were all considered tax-free compensatory damages. Damages awarded to punish defendants – punitive damages – were always taxable. Interest growth that a party earned from investing their payout and earning interest was also taxable. Finally, parties were able to deduct legal fees from their gross recovery and taxable income.

While punitive damages and interest growth are still taxable under President Trump’s new plan, there are significant changes regarding taxation of compensatory damages and the deduction of legal fees. For compensatory damages to qualify for tax-free treatment under the new tax plan, the recovering party’s injuries must be physical. Physical injuries include things like broken bones, paralysis, and other permanent physical disabilities. Under the new tax plan, compensatory damages for emotional distress or physical manifestations of emotional trauma are not tax-free. That means that if you were awarded damages because you suffered from depression, anxiety, post-traumatic stress disorder, or other symptoms of mental affliction, you will be taxed on the payout you receive.

If you have both physical and emotional symptoms, whether your payment will be tax-free depends on which symptoms caused or impacted other symptoms. For instance, if your physical symptoms – such as insomnia, headaches, or stomachaches – were triggered by your emotional distress, then your recovery would be taxable. If the reverse is true, and your physical symptoms caused your emotional distress, then your entire payment would be tax-free.

Another big change caused by the implementation of President Trump’s tax plan is that parties can no longer deduct legal fees from their total recovery and their gross income. Before the new tax plan, if your attorney received 30% of your settlement and you received 70%, then you would only have to pay taxes only on your 70% recovery. Now, if your attorney receives 30% of your settlement in legal fees and you receive 70% of the settlement, then you will have to pay taxes on 100% of the payout. There are only a few exceptions to this new policy. Your attorney’s fees can be excluded from your total income if you received compensatory damages for your purely physical injuries, there were no punitive damages awarded, and you are not earning interest on the payout. The same is true if the attorney’s fees were awarded by a court or required by statute.

It is still unclear how the new tax plan will actually affect payouts and settlements. Debates are certain to ensue over whether individuals suffered primarily physical or emotional injuries as to qualify for tax-free status. Parties may find that they need to reach out for additional tax help, so that they are prepared for any unexpected tax implications caused by the payout.

BROWN & KELLY SUPER LAWYERS 2017

We are proud to announce that Kenneth Krajewski and Renata Kowalczuk were selected as Super Lawyers for 2017. Jessica Burgasser was selected as a Rising Star. Inclusion in Super Lawyers is based on a rigorous, multi-step selection process, which includes background and experience as well as peer review recommendation.

MEET BOBBIE JO KELLER, MEDICAL RECORDS CLERK/PARALEGAL

Please meet another of our Paralegals, Bobbie Jo Keller. Bobbie Jo has been the Medical Records Clerk since 2014.

Bobbie Jo works on personal injury, lead paint, and products liability matters. She also assists with the gathering and analysis of treatment, employment and/or educational records; marshaling the records for Independent Medical Exams and communicating with the provider and/or agency; drafting discovery and pleadings; communicating with witnesses prior to, and during, depositions and trials; preparation of file analysis/strategy evaluations; trial preparation to include preparation of trial notebooks, document management, and assisting the handling attorney during the trial.

Bobbie Jo received her Bachelor of Science Degree in Forensic Science/Crime Scene Investigation from Hilbert College in 2008. She is also a member of the Western New York Paralegal Association.

Ten interesting facts about Bobbie Jo:

1. Bobbie Jo is a Wyoming County resident and thus, has a 1 hour daily commute. She endures the lengthy drive because she loves the country living of Wyoming County and refuses to move closer to the city.

2. She has been married for 6 years and is the proud mom of a 2 ½ year old son. She has a boxer named Dexter, and 2 cats, Rylie and Luckie.

3. Her favorite music is county music!

4. She loves watching tractor pulling and participating in her tractor pulling club, Eagle Garden Tractor Pullers Association.

5. Bobbie Jo’s favorite place she has visited is the Arenal Volcano in Costa Rica, and would love to return there someday.

6. She would also love to visit Paris, France.

7. Her favorite foods are Pizza and Ice Cream!!!

8. Her TV is usually set to the Disney Channel (Don’t judge. There are good family shows on the Disney Channel!)

9. Bobbie Jo loves monkeys!

10. When she was younger, she wanted to be an astronomer and work for NASA. She still loves astronomy. Her favorite thing to do in the summer is to sit by a campfire and look at the stars and constellations!

MEET DAWN LINDNER, LITIGATION MEDICAL COORDINATOR/PARALEGAL

Dawn M. Lindner has been with Brown & Kelly, LLP since 2005, and as one of our Paralegals, is the Litigation Medical Coordinator. She works with various attorneys in the litigation department handling all aspects of gathering the necessary treatment records, marshaling the records for Independent Medical Exams, and preparing medical analyses. Dawn also assists in preparing the attorneys she works with for trial by subpoenaing records and assisting with the compilation of trial notebooks. She assists in the Asbestos Department and is an assistant to one of our firm’s partners, Kevin D. Walsh.

Ten interesting facts about Dawn:

1. Dawn was born in Buffalo, but has lived in both Florida and Georgia and plans to retire to Georgia when the time comes.

2. Her favorite seasons are spring, summer and fall. She tolerates winter only because she has football to watch, which gets her through the winter months. Go Bills!!!

3. Dawn’s biggest accomplishment is being the proud mother of a 17 year old son, who is a senior in high school!

4. Her hobbies include: reading, knitting, crafts, camping, watching sports and movies, and hanging out with family and friends.

5. Her favorite music is county music, but she loves to listen to 80’s and 90’s music, as well.

6. Dawn’s favorite place to be would be somewhere nice and warm, enjoying the sun and breeze, while relaxing on a beach or camping in a nice country setting.

7. Her favorite food(s) are Italian, Mexican, and Chinese. Her favorite holiday is Thanksgiving.

8. Dawn’s favorite movies are: Bad Boys (1 & 2), as well as Rush Hour (1,2 & 3).

9. Her all-time favorite TV show was ER and her two favorite current shows are Code Black and Night Shift.

10. At one time, Dawn was going to school to become a nurse, but then life happened as it usually does, and ended up in the legal field. She accepted a legal assistant position with a local firm in the estates, wills and trusts department in 2000. In the 16 years since then, her legal experience has expanded to her present role as a Paralegal with the firm.

MEET LOUISE GIGLIA KLOS, BILLING COORDINATOR

Louise Giglia Klos was originally hired as a Legal Assistant but transferred into the Accounting Office when a position became available. She expanded the position and is now the Firm’s Billing Coordinator. Louise generates all the Firm billing, opens new matters, prepares account reconciliations, manages closed files, follows up on payments and client billing questions, posts cash receipts, and administers the escrow account transactions. She enjoys helping the Firm in any capacity which may include manning the reception desk by answering phones and greeting clients. “I have really enjoyed working here all of these years. It’s almost like a family and I really want to help co-workers in any way I can.”

Louise has been an employee of Brown & Kelly for 28 years. She attended Bishop McMahon High School and majored in Business Administration. She received her Associate’s Degree in Accounting at Erie Community College.

Getting to Know Louise:

I would love to visit Sicily and see where the family history all began – “Sometimes it is impossible to know where you are headed without reflecting on where you came from. Understanding your heritage, your roots, and your ancestry is an important part of carving out your future.”

I enjoy spending time with family.

My favorite place to be is Disney World, of course…with or without children (have done both);

I would love to learn a language; learn to play an instrument; do volunteer work; and be able to simply drive around the country seeing sights and meeting new people.